travel nurse salary taxes

Not just at tax time. Traditional full-time nurses receive a taxable salary from a single employer.

What Is Travel Nursing Academia Labs

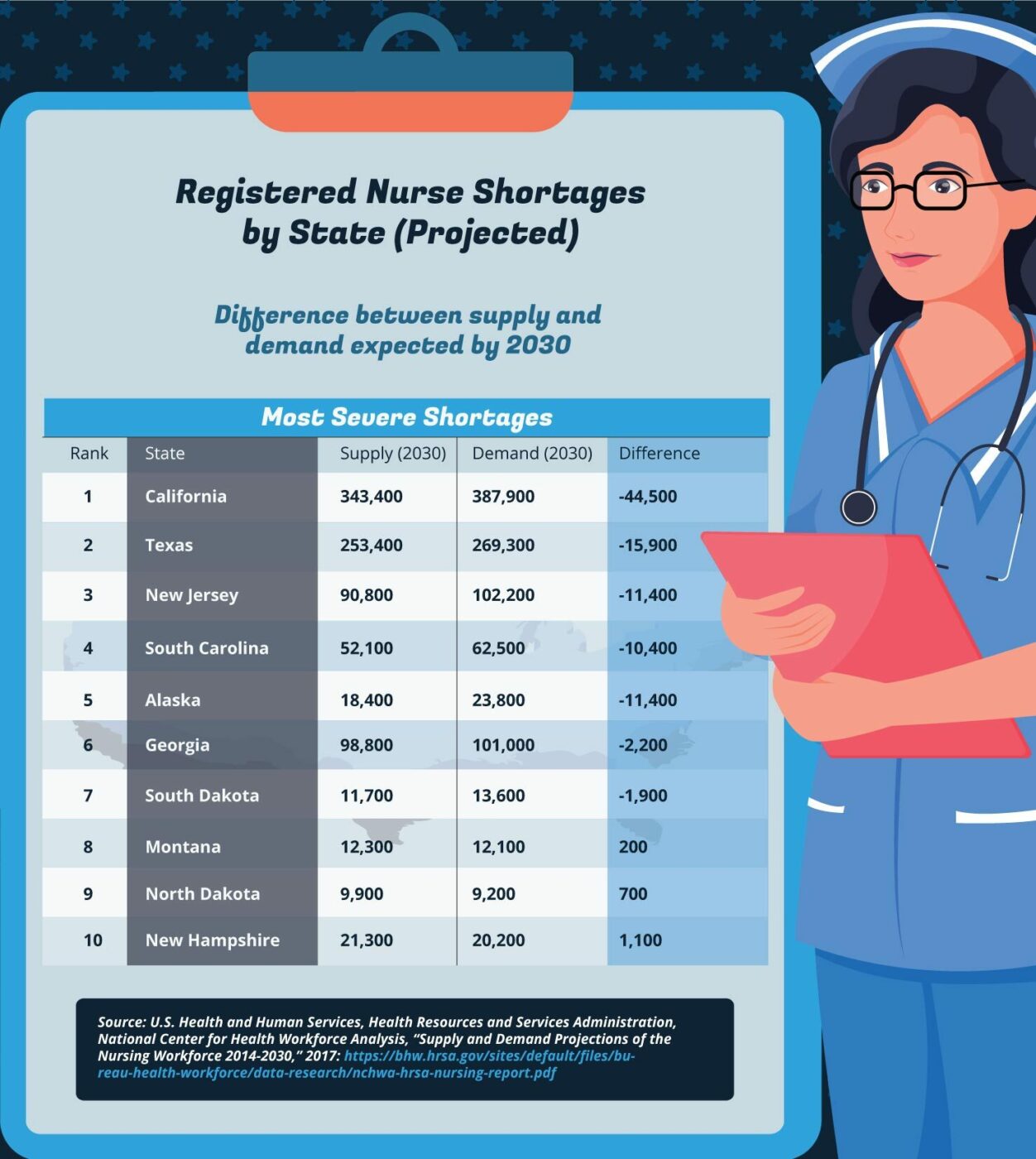

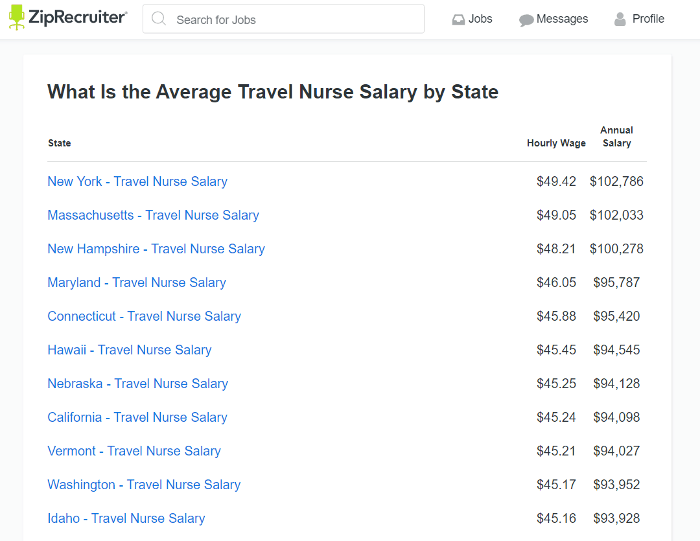

According to Vivian a healthcare jobs marketplace and the US.

. Having a professional help you with filing your taxes is always a smart decision. These practitioners can earn 1840-6340 per week averaging a 36-hour work week. As mentioned above 1099 travel nurses have to pay the 153 SE tax rather than ½ of FICA for W2 employees.

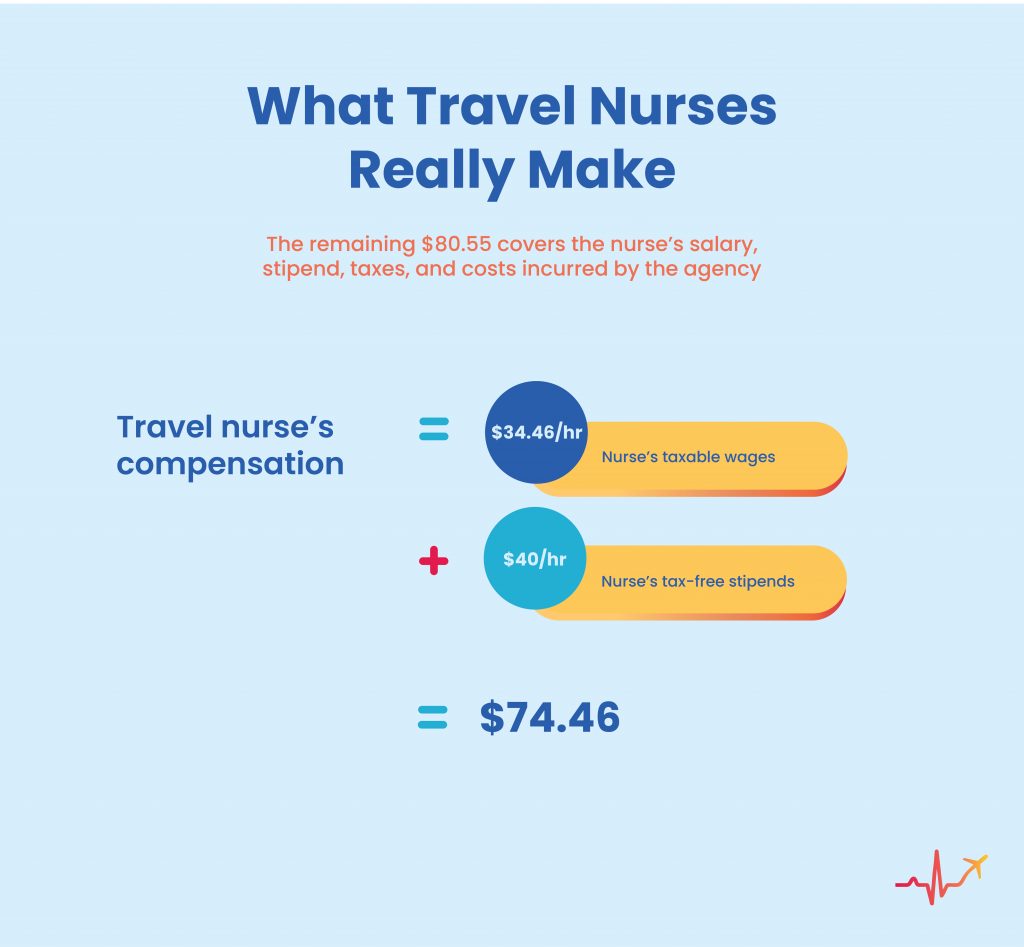

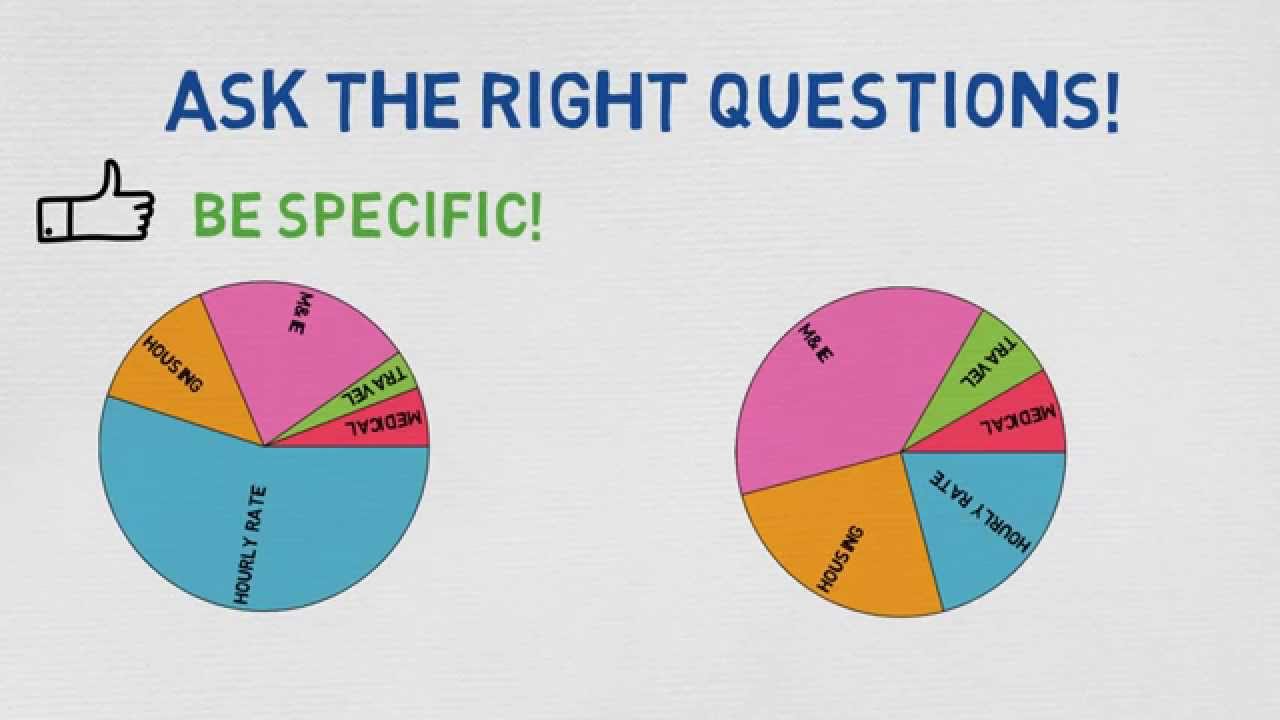

A blended rate combines an hourly taxable wage such as 20 an hour with your non-taxable reimbursements and stipends to give you a higher hourly rate. Bureau of Labor and. This is especially true for those of.

Spend at least 30 days of the. Great Benefits Pay. Great Benefits Pay.

Travel Nurse Tax Deduction 1. Here is an example. Resources on tax rules for travelers and some key points.

This is because travel nurses are paid a base hourly rate that. You must have regular employment in the area. Taxable income is base pay.

Ad Choose Your Travel Nursing Career. The monthly salary for travel nurses averages out to 9790 and may vary depending on. The 50 Mile Rule is one of the most common fallacies pertaining to tax-free reimbursements for travel nurses.

Ad Choose Your Travel Nursing Career. The regular taxable hourly rate plus nontaxable reimbursements also called stipends subsidies allowances or per diem. To claim the tax benefits of being a travel nurse your tax home must fit these requirements.

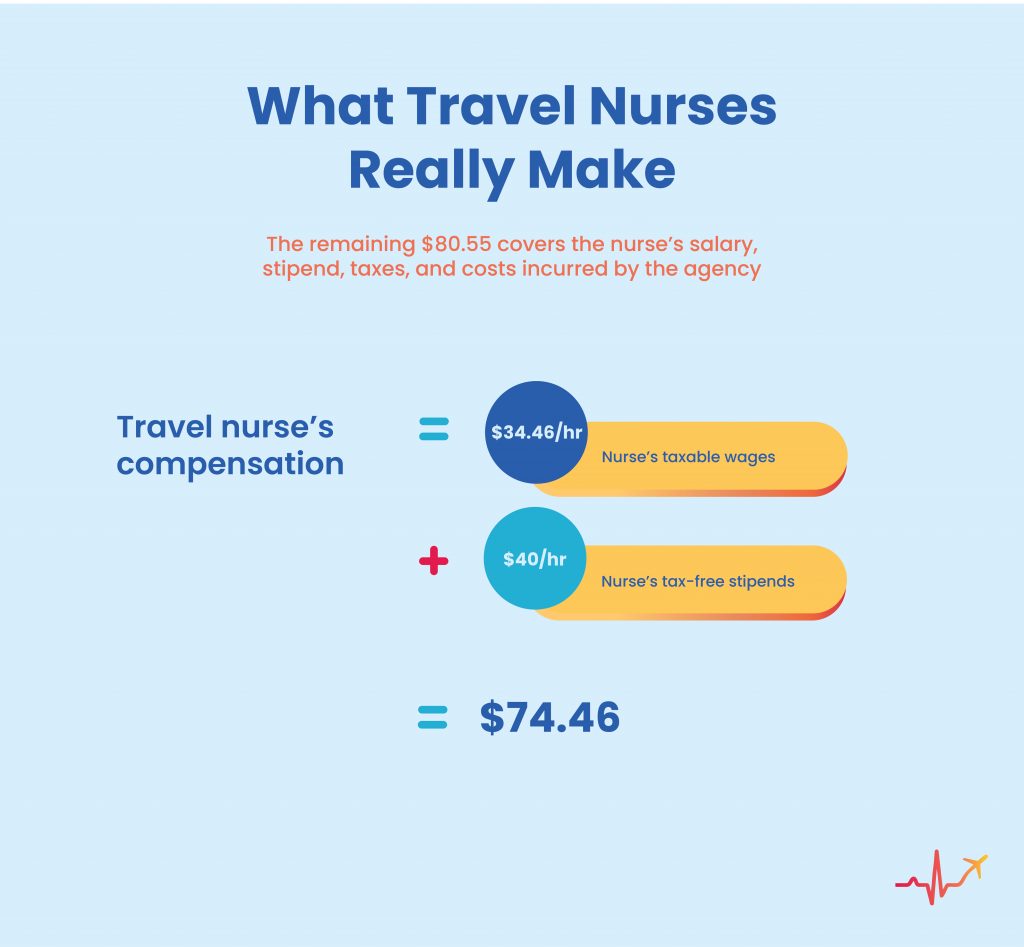

Yet a travel nurses pay generally consists of two main components. Non-taxable reimbursements are stipends for lodging food and travel costs. These stipends and reimbursements are for expenses such as meals parking transportation fees and.

Tax-Free Stipends for Housing Meals Incidentals. Work with a professional. Travel Nursing Pay The 50 Mile Myth for Tax Free Stipends.

22 for taxable income between 40126 and 85525. As mentioned above we simply subtract the estimated weekly taxes from the weekly taxable wage and add the remainder to the total weekly tax-free stipends to calculate. Its also worth really familiarizing yourself.

In order to minimize the amount of tax you have to pay and to take advantage of the tax deductions for travel nurses you may qualify for you need to understand the ins and. Typically there are stipends or reimbursements for travel nurses. Because travel nurses are paid a bit differently than staff nurses so too do travel nurses file taxes a bit differently.

When doing proactive planning Willmann says its important to pay. Youve got questions about travel nurse compensation. Weve got all the answers.

Your listed bill rate typically takes all of this into account. 24 for taxable income between 85526 and 163300. Travel nurses on the other hand receive a base rate and a reimbursement or an allowance for housing food and.

It is also the most important since the determination of whether per diems. For an assignment to be considered temporary it must be expected to last less than one year. As a travel nurse working outside of your tax home you are eligible for tax-free stipends in addition to the hourly wages you earn.

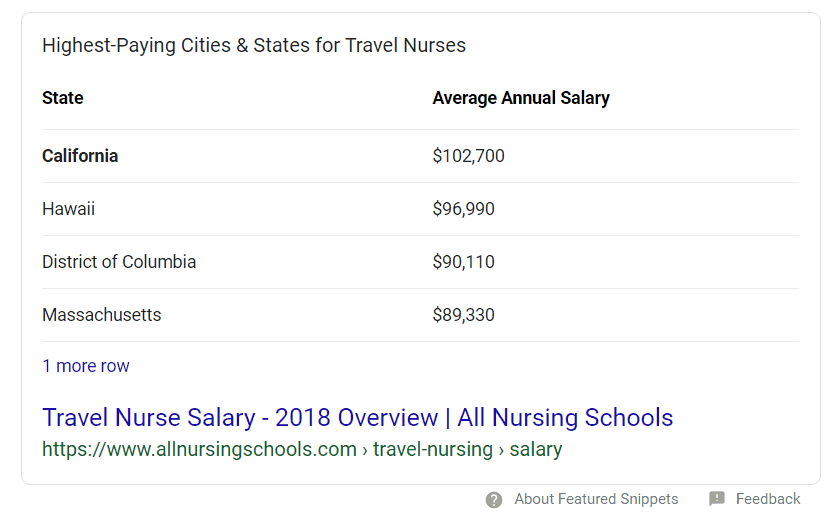

This is because companies can legally reimburse its nurses for certain expenses incurred while working away from home you. In California Tax-Free Stipends can be as much as 1800 per week for housing in San Francisco and 500. Travel nurse pay guide.

Joseph Smith EAMS Tax an international taxation master and founder of Travel Tax explains that in addition to their base pay most travel nurses can reasonably expect to see. Travel nurse earnings can have a tax advantage. One of the many incentives medical companies may use to entice traveling nurses is through the use of per diems wages paid for daily living expenses such as food gas or.

Im only going to address the issue of tax-free stipends aka per diems the IRS kind not the nurse shift kind for nurses. 5 Tax Tips for Travel Nurses. Do travel nurses have to pay California taxes.

Quarterly Taxes 1099 employees expecting to owe over 1000 in taxes have to. This is the most common Tax Questions of Travel Nurses we receive all year. If you choose to take a higher hourly wage youll pay more in income taxes than if.

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

How To File Your Taxes As A Travel Nurse Ioogo

How Much Do Travel Nurses Make Factors That Stack On The Cash

Travel Nurse Salary Comparably

How To Make The Most Money As A Travel Nurse

Trusted Event Travel Nurse Taxes 101 Youtube

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Everything About Travel Nursing Taxes And Tax Free Money Bluepipes Blog

Complete List Of Average Nursing And Travel Nursing Salaries By State By Nomad Health Nomad Health Medium

Travel Nurse Insight What Goes In To Pay Packages

How To Calculate Travel Nursing Net Pay Bluepipes Blog

How To Evaluate Travel Nursing Pay Packages On Facebook Bluepipes Blog

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

Travel Nurse Tax Deductions What You Need To Know For 2018

Is This A Good Travel Nurse Contract A Behind The Scenes Look Youtube